Your rates invoice contains two key documents – your Rates Invoice and your Rates Assessment.

You will receive your invoice for 2024/2025 in September. If you have not received it by 30 September please contact us using our online rates query form and select the 'Have not received my invoice' option.

What you’ll receive

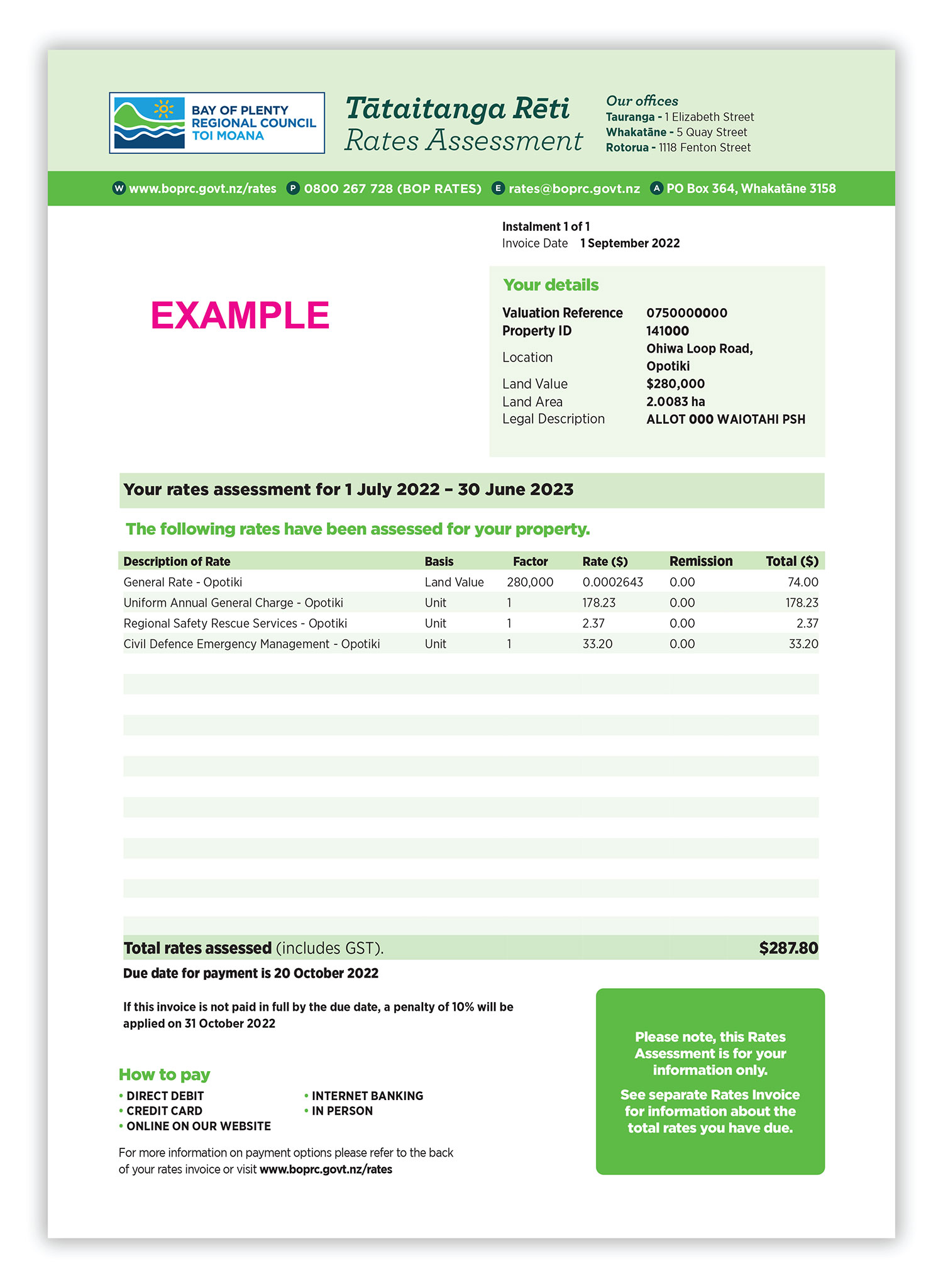

Rates assessment

Your assessment sets out the different parts to your rates, and how your total amount owing has been calculated for the year.

Please note that the rates shown on the assessment will vary across the region depending on the different types of targeted rates that will apply.

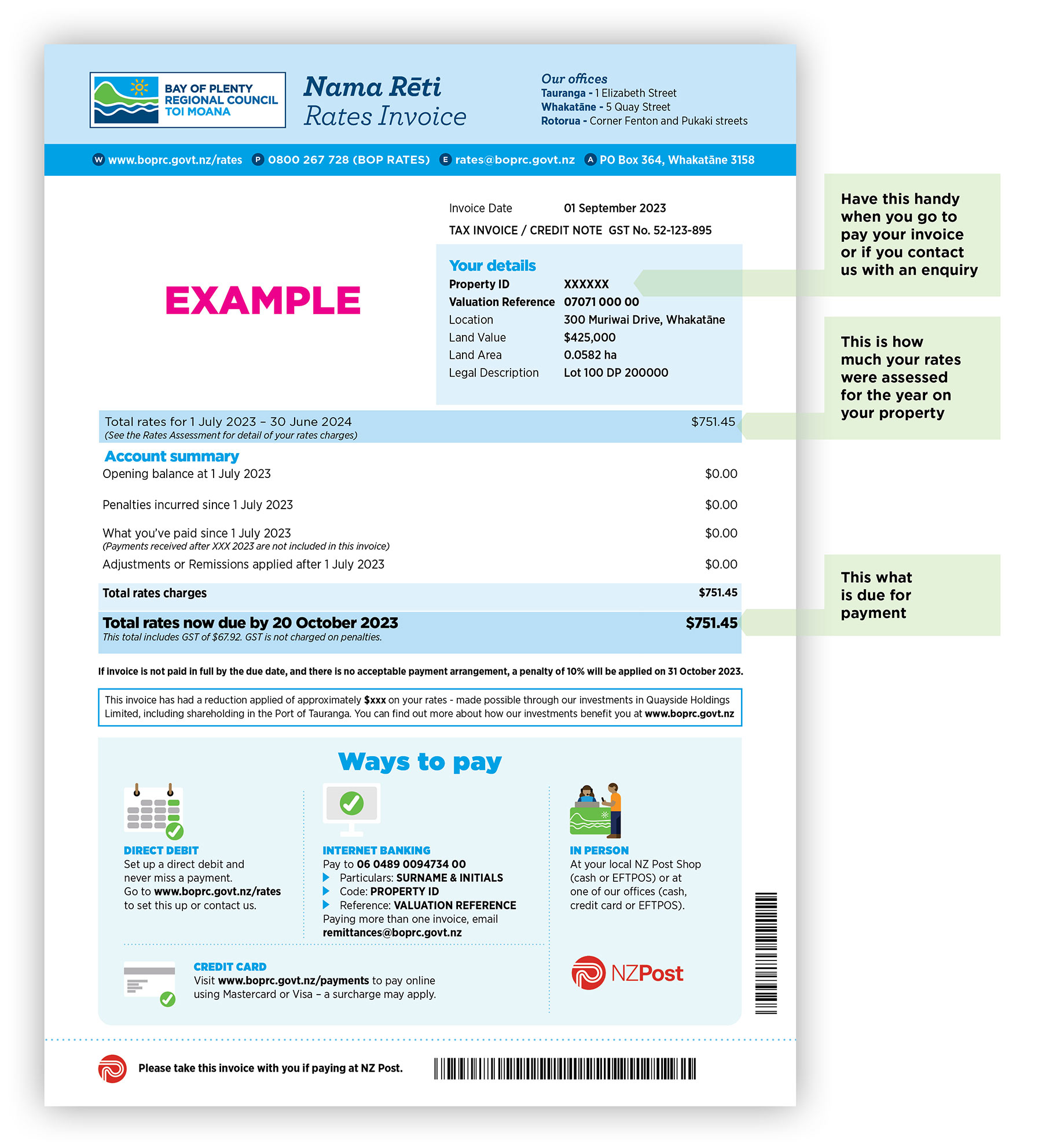

Rates invoice

Your invoice sets out what your yearly rates are, anything you’ve paid us towards it, any adjustments that have been made to your invoice and the amount you need to pay on or before on the due date for payment.

What is the Quayside Holdings Limited reduction on my invoice?

Every year Bay of Plenty Regional Council receives a dividend from Quayside Holdings Limited. The reduction shown on your invoice is an indication of the benefit the dividend from Quayside Holdings Limited has made to your rates bill. If the dividend wasn’t received by the Regional Council, your rates would be higher by this amount. You can find out more about this reduction on our rates information hub.

Receiving rates by email

You can go paperless by signing up to receive your invoice by email. If you want to sign up to receive your rates correspondence by email, please complete our online form.

Rates remissions

You may be eligible for a reduction on the rates you owe through a rates remission. We have two remissions policies for all land based on certain criteria and the other for Māori Freehold Land.

Still have questions? Visit our rates information hub.